DECEMBER 2020 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

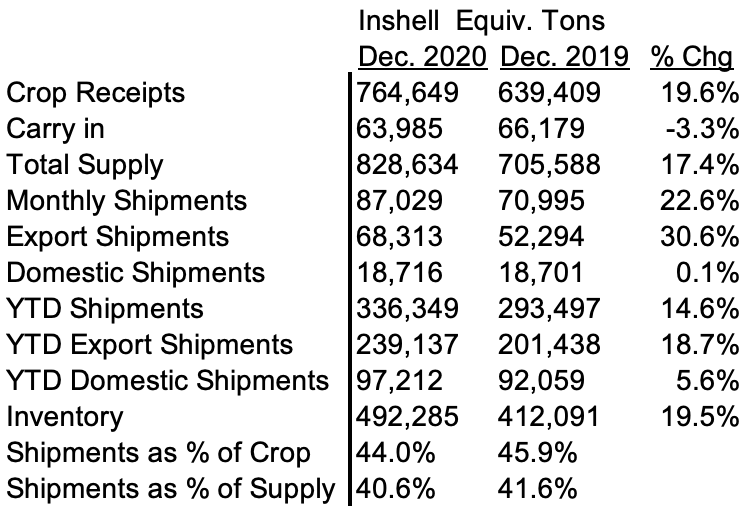

The California Walnut Board released the Dec. 2020 Position Report. Our table of these figures are shown below:

MMR

This is the 4th month of the 2020-2021 walnut season, so a third of the way through. Receipts are up to 764,649 inshell ton compared with the prior year at this time of 639,409 inshell ton. Extrapolating last year’s receipts at this time or 98.26% of the final crop would yield an estimated 2020-2021 final receipt of 778,189 compared to the estimate of 780,000 ton. This will be an unbelievably accurate estimate. Shell out rate is estimated at 43.7% this year versus 42.6% last year but quality is reported to be only fair with packers advising that Chandler has much more “color” than they would otherwise like. Some packers have also reported higher amounts of mold and insect damage thus increasing labor time and costs, a double burden paired with Covid related personnel challenges. Combo and domestic light will be very prevalent this year and a better value. Good quality Chandler will be a challenge for most packers aiming to satisfy J-Spec and K-Spec contracts. Packers will be very conservative in their Chandler prices and offerings. They cannot afford to be short this year as they will have a hard time buying good quality from the outside if they are short.

Monthly inshell (total) equivalent shipments +22.6% vs. PY

– Export inshell equivalent shipments +30.6% vs. PY

– Domestic inshell equivalent shipments +0.1% vs. PY

The monthly performance discrepancy between Domestic and Export is due to Export Inshell up 46% and Export Kernel up 24.86%. Domestic inshell, while up 62.5%, this volume is negligible and Domestic kernel is up only 1.17%. Perhaps Domestic kernel is lagging as retailers try to liquidate higher priced contracts without losing money or are slow to lower prices to a true intrinsic level to try to make a profit until the public catches on. There also could be some Covid effect where the U.S. is arguably the most affected country with the highest Covid rates and seemingly the farthest of all the countries in terms of getting back to normal.

YTD September-December 2020 + 14.6%

– Export inshell equivalent shipments +18.7% vs. PY

– Domestic inshell equivalent shipments +5.6% vs. PY

All metrics are up. Total 4 month Inshell up 21.78%. Total 4 month Kernel up 13.23%. Domestic Inshell up 17.85%. Domestic Kernel up 7.74%. Export Inshell up 21.93% led by Turkey up 9%, UAE up 3%, India up 229% and Vietnam up 32.26%. Italy was down17% and Spain was down17.8% but on small volume. Export Kernel was up 18.22%.

4-month shipment assessment – Shipments during the 2019-2020 first four months last year were 293,497 inshell ton compared with 336,649 inshell ton so far. This means the remaining 8 months last year averaged 43,513 ton to leave a carryout of 63,985 ton. Now, for the remaining 8 months, you have to average 53,537 ton each month to leave the same carryout. So a higher monthly average with poorer remaining quality in a Covid world.

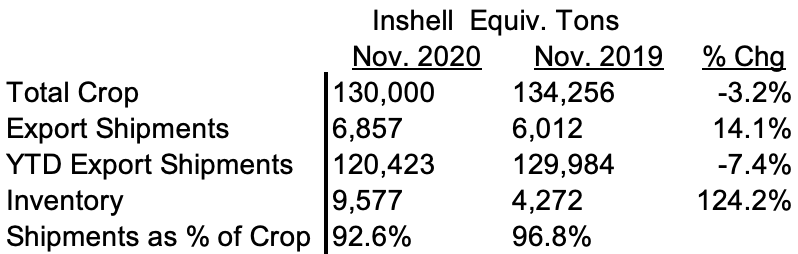

Chile

Chilenut released November Walnut Position report with shipment of 6,857 tons compared to last year of 6,012 tons increase of 14.1%. For the YTD shipments; UAE down 64%, Turkey down 30%, China up 8% and India up 139% compared to last year. YTD shipments are 120,423 tons compared to 129,984 tons last year a decrease of 7.4%.

Gulfood is usually a great opportunity for Chileans to start offering new crop however most Chileans are not expected to attend Gulfood this year. After last year’s poor quality many buyers are also reluctant to buy from Chile until harvest. Chile is potentially a non-factor until April.

Current Inshell and Kernel Prices

Quality is a bit suspect on remaining Chandler inshell. J/L Chandler’s $.88 to $.92/lb, Jumbo Chandler $.94 – .96/lb. Chandler LHP 20’s currently in the $2.30 to $2.40/lb range. Domestic LHP is $1.90 – $2.10/lb range and Combo Halves and Pieces in the $1.70/lb to $1.90/lb range. Chandler halves are hard to find and if found in the $2.70 – $2.80/lb range.

CONCLUSION

While the report seems bullish upon initial observation, the conclusions are a bit unclear. Continued container issues pushed some October shipments into November, November shipments into December and some December shipments into January 2021. This could stretch the shipping season a bit but would also be offset by some buyers who no longer need goods due to shipment delays. The January 2021 shipping report will be most interesting.

Packers are still very busy getting orders out with personnel issues due to Covid affecting most packers in some manner. Some packers only have 2-3 table sorting people per line and loads are taking longer to prepare. Additionally the higher mold and insect damage exacerbate the personnel problems. Packers we deal with are pretty comfortably sold at 85-90% shipped and/or committed. These packers are either not offering or are very picky in their offers. We understand that the Walnut Board will be implementing a “Commitments” line much like the Almond Board report but don’t expect that to be implemented in the next quarter. This Commitments line in the report will help to provide clarity as to really how much inventory is uncommitted.

The USDA Section 32 just announced an additional $20 Million in walnut buy for the 2021 second quarter. This will provide much help to the industry to move combo product at attractive prices to the government for Section 32 needs.

Good quality Chandler will continue to be a challenge yet there are very good offerings on combo halves and pieces and domestic light halve and pieces. Normal issues will come up like the April cold storage pressure on packers and Chilean crop and pricing influences also in April for shipment in May 2021.

Can the Walnut industry move an average of 53,537 ton in each of the next 8 months to exit the season with a similar carry out as it carried in? Some would argue that as crops get bigger and the market expands, the carry out should expand as well? Maybe to 100,000 ton thus only necessitating monthly sales of 49,000 ton which is reasonable?

Without further large volumes of inshell sales and with Chandler seemingly tight, can the industry move large amounts of combo and domestic light halves and pieces? Will buyers see that the value in the crop is CHP and domestic LHP and that a $.60/lb spread between CHP and Chandler LHP or a $.40/lb spread between domestic LHP and Chandler LHP is quite large?