JANUARY 2021 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

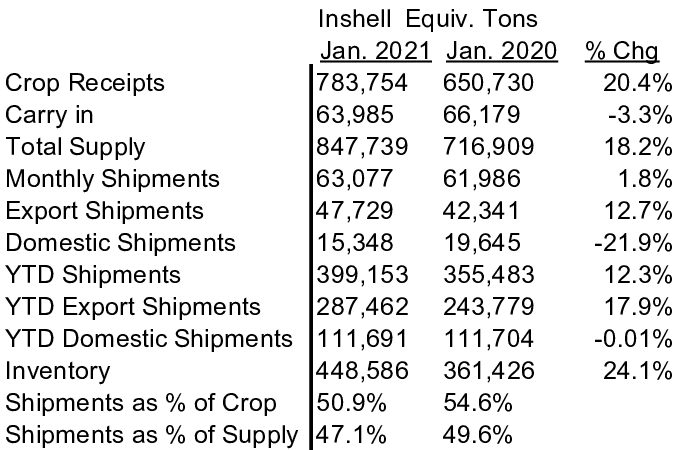

The California Walnut Board released the Jan. 2021 Position Report. Our table of these figures are shown below:

MMR

This is the 5th month of the 2020-2021 walnut season. Receipts are up to 783,754 inshell ton compared with the prior year at this time of 650,179 inshell ton and compared to the estimate of 780,000 ton. Shell out rate is estimated at 43.7% this year versus 42.6% last year.

– Quality is reported to be only fair with packers advising that decreased Chandler quality is making it more difficult to pack J-Spec and K-Spec and with Covid-19 issues, packing is a challenge.

– Packers have also reported higher amounts of mould and insect damage adding to the challenges

Monthly inshell (total) equivalent shipments +1.8% vs. PY

– Export inshell equivalent shipments +12.7% vs. PY

– Domestic inshell equivalent shipments -21.9% vs. PY

Fortunately, January monthly export inshell was up 54.5% led by Turkey (up 137.5%), Italy (up 36%) and Spain (up 203%). In contrast, Domestic Kernel was down -20.76% and Export Kernel only up 1.76%. Packers are still struggling to get goods shipped with the lack of vessels, shipping containers and numerous vessel “rollovers” backing up inventory at packers’ plants. In Long Beach, dozens of vessels with no place to berth, are stranded in open waters not able to deliver its cargo, empty those containers and set sail abroad. The basically flat 1.8% performance for the month is largely attributed to these backups.

YTD September 2020 – January 2021 + 12.3% vs. PY

– Export inshell equivalent shipments +17.9% vs. PY

– Domestic inshell equivalent shipments -0.1 vs. PY

While the 5 month year to date total is up at 12.3%, this stat was14.6% at 4 month mark. Export Inshell was up 25.4% led by Turkey up 16.6%, Pakistan up 147 fold over the previous year and India up 166%. Almost every major inshell importer was up. On the kernel side, domestic kernel was up just 2.31% while export kernel was up 14.13%. Domestic kernel was disappointing and the industry does not have to worry about vessels and containers to ship domestically. Domestic kernel shipments were disappointing considering there were no export vessel problems to blame.

5-month shipment assessment – Shipments during the 2019-2020 first 5 months last year were 355,483 inshell ton compared with 399,649 inshell ton so far. This means the remaining 7 months last year averaged 42,491 ton to leave a carryout of 63,985 ton. Now, for the remaining 7 months, you have to average 54,943 ton each month to leave the same carryout. So one would think that this report is bearish. But wait!

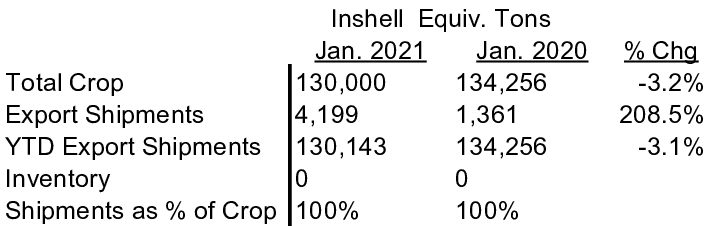

Chile

Chilenut released January Walnut Position report with shipment of 4,199 tons compared to last year of 1,361 tons increase of 208%. For the YTD shipments; UAE down 64%, Turkey down 30%, China up 8% and India up 141% compared to last year. YTD shipments are 130,143 tons compared to 134,256 tons last year a decrease of 3.1%.

Chile is expected to offer new crop at 1st week of March. Chilean are closely following USA prices and expected offer inshell chandler anywhere between $2.60/kg and $3.00/kg CIF. California’s well sold position in inshell chandler might consider Chileans to start offering closer to $3.00/kg CIF. Many buyers are reluctant to buy from Chile after last year’s poor quality and with higher walnut prices and bigger crop many buyers might prefer to wait until harvest.

Current Inshell and Kernel Prices

Quality is a bit suspect on very small amounts of remaining Chandler inshell. J/L Chandler $.95/lb, Jumbo Chandler $1.00/lb. Chandler LHP 20’s currently in the $2.45/lb to $2.55/lb range if you can get an offer. Domestic LHP is $2.20/lb to $2.30/lb range if you can get an offer. Combo Halves and Pieces in the $1.90/lb to $2.10/lb range. Chandler halves are virtually impossible to find and mostly in the $3.30/lb to $3.40/lb range if you can get an offer.

CONCLUSION

So at first glance this report seems to be unusually bearish but we actually seem to be in a very bullish market. Why? How can the numbers speak loudly on bearishness yet reality seems to suggest something totally different? 1) Covid-19, 2) Poor quality, 3) Transportation and Logistics 4) Lack of understanding of Walnut Commitments due to this information not being on the Walnut Board Report, 5) USDA walnut buys.

Covid-19 – Enough said

Quality – Quality is down. With quality being down it takes more time, labour and tonnage to pack an export quality load than before. When quality is down, costs go up.

Transportation and Logistics – Talk about not being in control. Packer struggles to pack the load. Cannot get a booking. Finally gets a booking. Then the booking gets rolled once or twice. Loads pile up at packers warehouse. Frustration builds. Plus, if your warehouse if full of loads that still need to ship and you need to ship more the following month, do you still offer more loads on a spot basis if you actually have it?

Walnut Commitments – There is no data to get an understanding of commitments on the CWB MMR. There could be lot of inventory or a little, we just don’t know. Many packers we deal with are either sold out or within 5% of being sold out.

USDA Walnut buys – The USDA continues to buy walnuts. They would rather provide people with food rather than send out checks which are ripe for fraud or misuse. There is word on the street is that there is another $25MM USDA walnut buy to be announced in the next week. That is over 300 truckloads.

So here is the scenario that many packers will put forth The Walnut Industry has shipped 50% of the crop already. The Walnut Industry has 15% of the tonnage packed and ready to ship but cannot ship due to the shortage of vessels and containers with no end in sight. The Walnut Industry has further commitments of say 20% leaving only 15% of the remaining goods to sell. Much of that remaining stock will be in Domestic Light and Combo but since there is little Chandler remaining, much of the light colour demand will be fulfilled out of the Domestic Light category. Combo will be eyed by the USDA walnut buy programs. Case closed so they say.

Packers are desperate to get their growers a better return after selling or committing to relatively cheap prices for 85% of the crop so they will try to ride the wave as long as possible and they will not be quick to reduce prices.

Chile will come out with prices in March and they will begin shipping in May and they will not be initially cheap feeling that they won’t have competition from California for 6 months. California will try to ride this price momentum through the normally slower Summer months and the normally more motivating cold storage season starting in April.